private reit tax advantages

Heres my two cents on private REITs. Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors but.

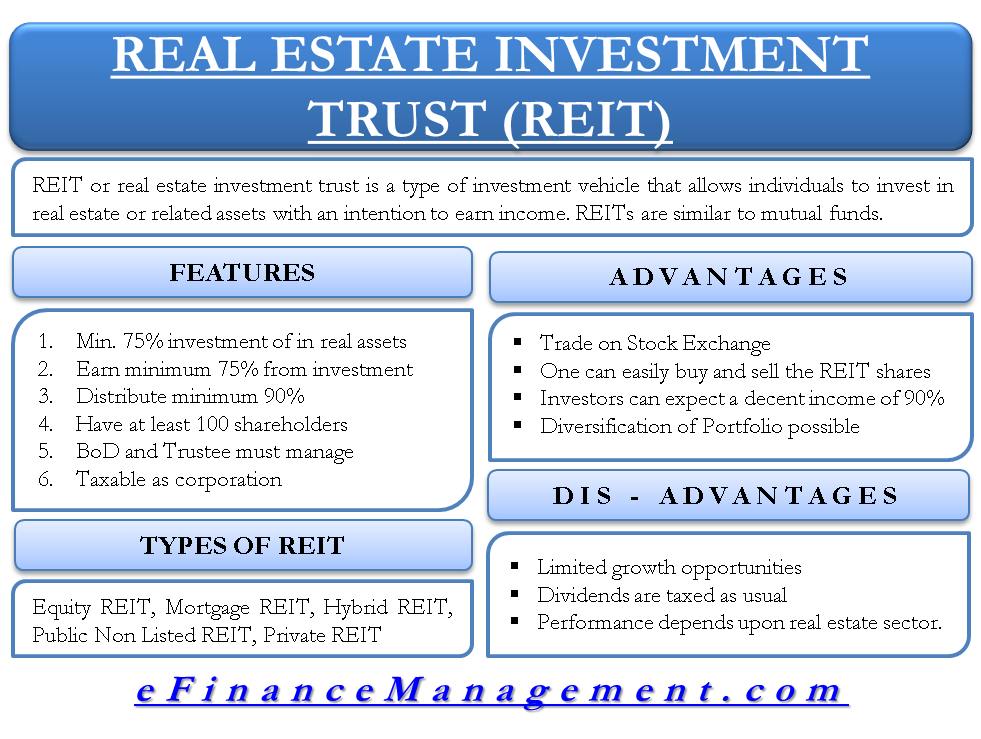

Guide To Reits Reit Tax Advantages More

Limited partnerships and limited liability.

. The list below summarizes a few of the main advantages. Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits.

Long-term capital gains are taxed at lower. Investing in a REIT is a third investing option in addition to stocks and bonds. Private REITs are typically more exclusive and may not be accessible to everyone.

If the REIT held the property for more than one year long-term capital gains rates apply. A REIT might also be a more stable investment as its less vulnerable to market fluctuations and inflation. Tax Advantages of REITs.

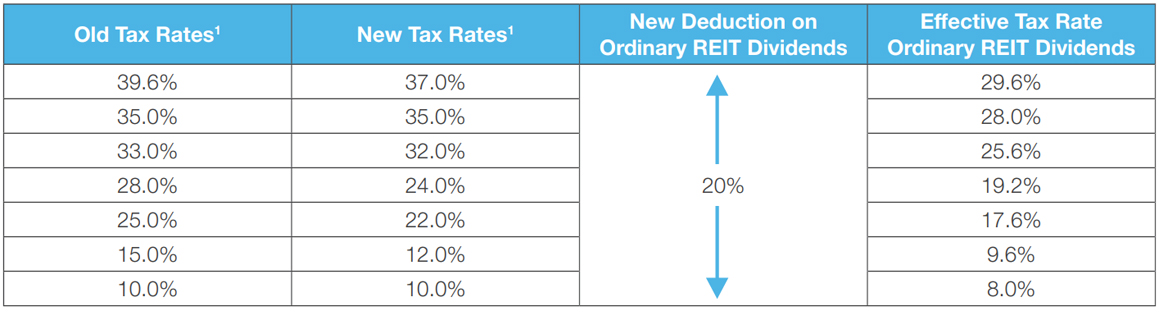

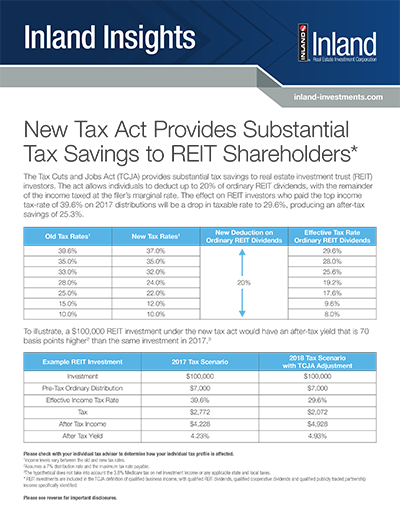

In addition REITs are subject. Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in some favorable tax. REIT investors can deduct up to 20 of ordinary dividends before income tax is.

If you hold an asset for a year or more you will pay long-term capital gains tax which is much lower than ordinary income. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Get your free copy of The Definitive Guide to Retirement Income.

The REIT does not pay tax on its income due to the dividends paid deduction and the REITs UBTI generally does not flow through to its tax-exempt investors. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. The second primary advantage is long-term capital gains.

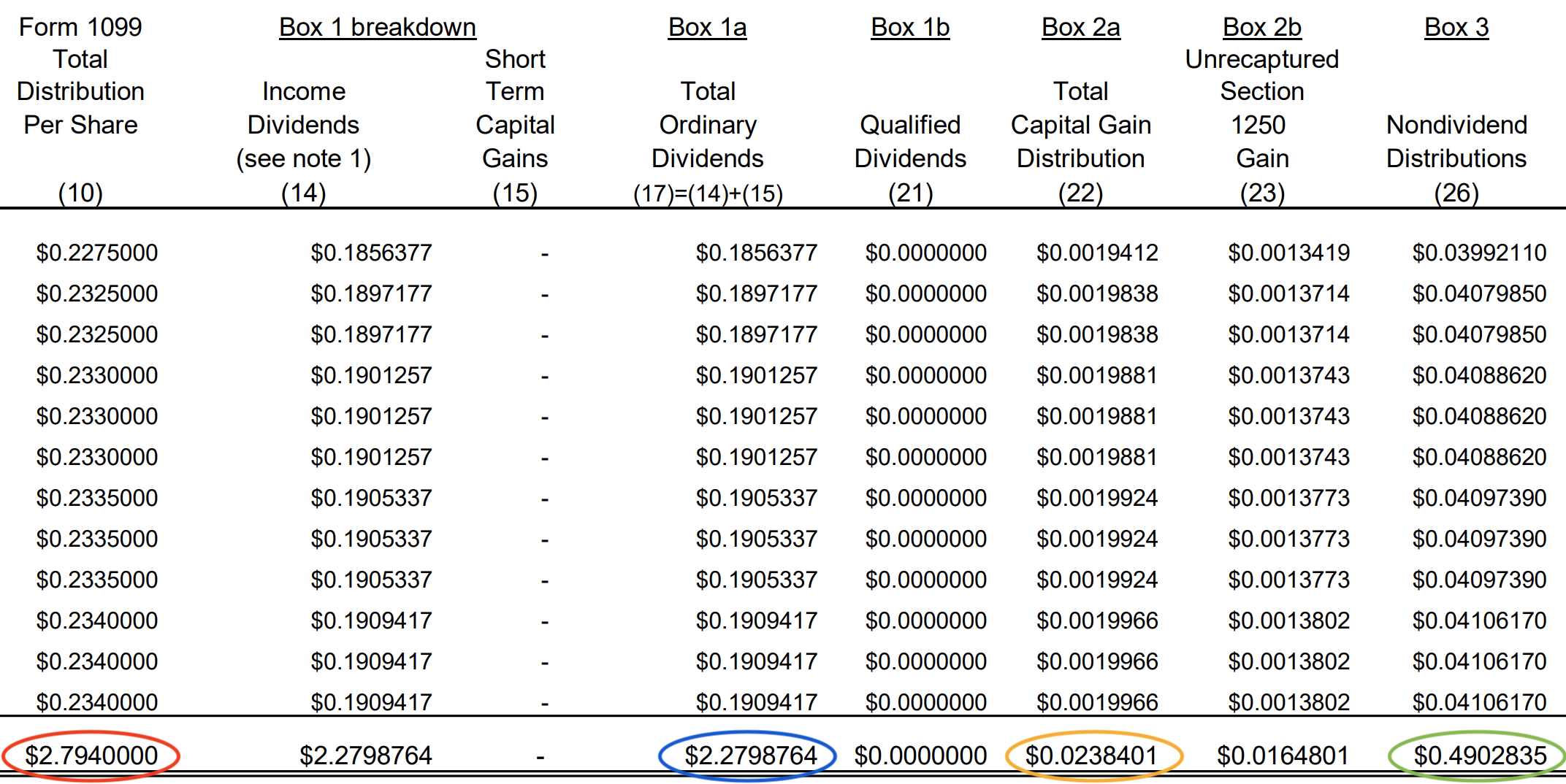

Get your free copy of The Definitive Guide to Retirement Income. BREITs Return of Capital ROC 1. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

Ive evaluated many private REITs and. BREIT is structured as a Real Estate Investment Trust REIT and. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Created with Highcharts 822 90 100 92 2019 2020 2021. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units. Ad iShares ETFs Can Help Generate Income From Stocks And Bonds.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Because a REIT is required by law to distribute 90 of its profits to investors that. McCann Esq and Philip S.

Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation. The private equity firm passes all tax benefits on to its investors including depreciation and capital recapitalization while REIT payouts are taxed at an investors higher. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

When you investigate a private REIT as an investment option. This inevitably leads to a better potential for higher returns private REITS are able to consistently pay out greater dividends than public REITs. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

REIT investors can deduct up to 20 of ordinary dividends before. REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment. Entities qualifying for REIT status under the tax code receive preferential tax treatment.

Tax advantage of REITs. REITs lack the leverage advantage offered by financing rental properties. In many cases such as with ours a private REIT can not only provide investors with income distributions but.

In truth a well-managed private REIT understands the advantages of educating and empowering its investors. Reits Why Investors Select Private Real Estate Instead Seeking Alpha. The income generated by REITs is not taxed on the corporate level and is.

Understanding the Tax Benefits of REITs.

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Guide To Reits Reit Tax Advantages More

Sec 199a And Subchapter M Rics Vs Reits

5 Tips For Real Estate Investment Success Management Guru Real Estate Investing Real Estate Buying Property

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Restricted Stock Learn Accounting Finance Investing Accounting Basics

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

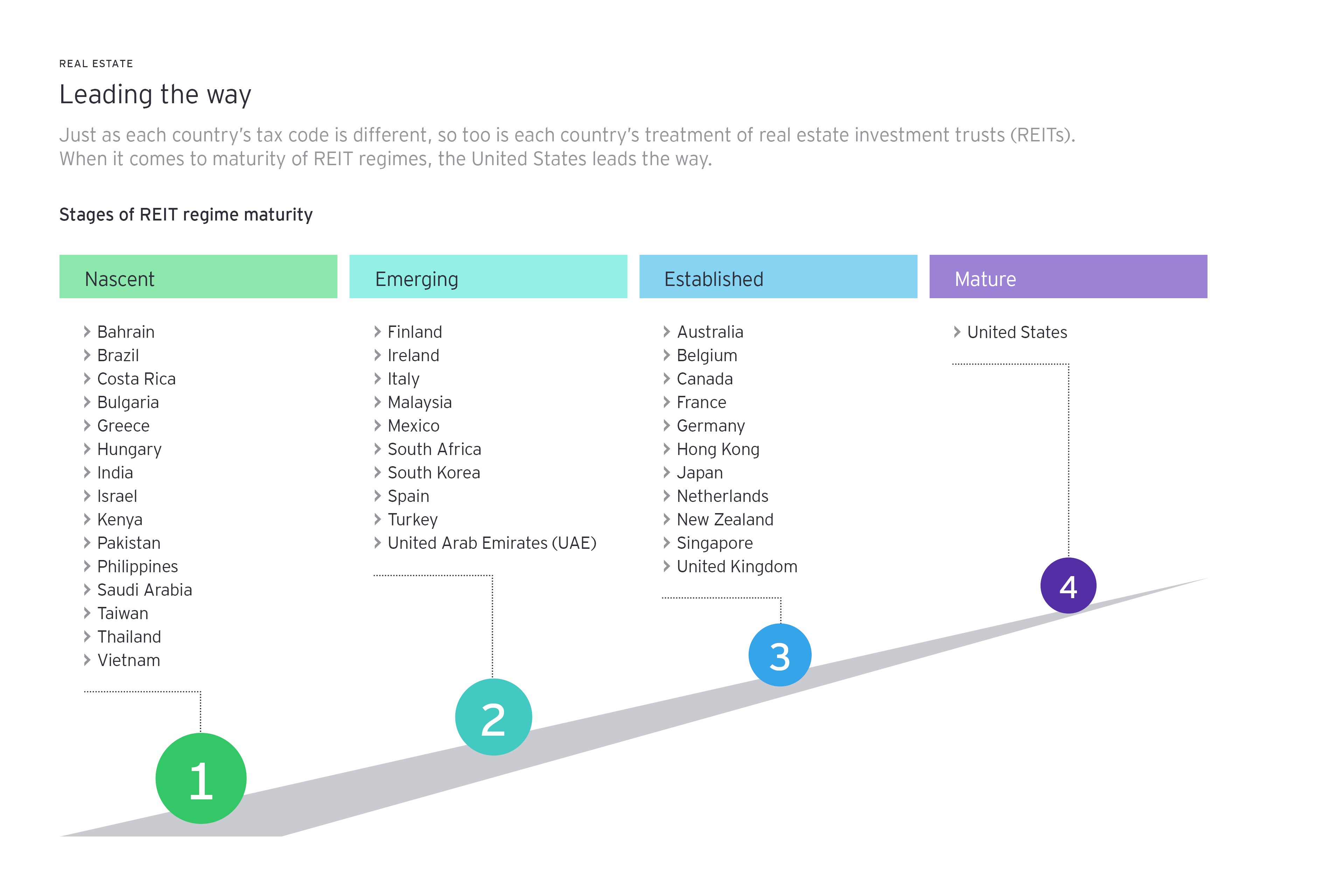

How Reit Regimes Are Doing In 2018 Ey Slovakia

Reit Or Real Estate Investment Trust All You Need To Know

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Understanding The Reit Taxation Rules Novel Investor

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen